There’s something strange deep within us that for some reason desires complexity. I can’t fully explain it. Maybe it’s the pressure to keep pace with those around us, or gain some sort of advantage, or perhaps it’s just the refusal to accept the notion that anything simple could be of any value.

Regardless of why we have this urge to complicate, the results of over complicating can be seen in numerous aspects of our lives. Over Complication can lead to:

- Greater chance of error (due to too many moving parts to effectively manage)

- Increased stress & anxiety

- Greater demand of your time, talents, and resources

It’s ironic in the sense that sometimes we add complexity under the guise that we do it to benefit other people. “I’ll add another evening of work to boost our income”, “I’ll try to do my own taxes to save money”, or “I’ll make more money for retirement by opening more accounts”. We do these things normally with good intentions, with the hope that they are truly adding value to someone or something. However, the unintended consequence sometimes of adding complication is that it takes you AWAY from those you are trying to help (in terms of your ability to spend quality time, can cause emotional disconnect, leads to physical and mental exhaustion, etc.).

I love helping people simplify. I get great satisfaction in helping people unwind (or avoid all together) unnecessary complication. I’ve observed in people’s personal finances where folks are trying to better their position (or the position of someone they care about) so they add more complexity. I’ve seen this lead to people getting so overwhelmed with their finances, that they simply avoid making any further decisions…too intimidated to deal with it anymore. Worse yet, I’ve seen where the person that created the complexity passed away, leaving someone else to try to weave through whatever financial maze was created.

It’s not to say that all complexity is bad. For example, if someone’s trying to save money for their kids’ education, a “simple” way to do that might be to open a savings account or perhaps buy CD’s to park their education savings. This would certainly be a simple solution and easy to manage, but will it help you accomplish your goal of paying for a college education? Maybe, but probably not. Adding some complexity in the form of some investments might be necessary to help you reach your desired goal. You just have be aware of and fight the urge to add more complication than what’s truly needed.

“Simplicity is the ultimate sophistication” Leonardo Da Vinci

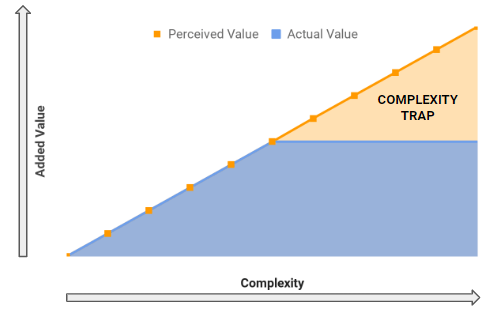

In some ways, complexity can be a trap. We find ourselves thinking it will always add equal (or even greater) amounts of value for every unit of complexity we add. However, there reaches a point (which we’ll call the “Complexity Trap”) where the perceived benefit far outweighs the actual benefit of adding complication to a situation.

Which leads us to examine what areas of our lives have strayed too far away from the simple?

What are you currently over complicating?

What things do you find you are unnecessarily doing?

In regards to finances, what areas of your financial life can you look to simplify and still reach your goals?

Lastly, what’s your action plan to simplify? Who can help you?

Here are 9 “simple” suggestions to consider as you begin to travel down the road of simplifying your finances:

- Gather Your Information – you can’t fully begin to simplify until you know what you’re dealing with. Gather up those bank statements, tax returns, investment reports, etc. that you’ve conveniently been avoiding and pull them all together.

- Organize – Throw away what you don’t need. Come up with a system to stay organized. Figure out what should be kept and how long you may need to keep it.

- Consolidate – there may not be a need to have 3 bank accounts, 4 old 401k plans, and 3 brokerage accounts. Keep in mind, the more spread out your finances are, the harder it can become to manage and stay on top of them. Look for overlap and for opportunities to streamline things.

- Manage Credit Cards – you probably don’t need 5 credit cards (average American household with credit cards have 3.7). Be aware of the consequences of canceling cards before you go down this road but consider what card(s) make sense to keep.

- Automate Bill Payments – reduce the risk of missing payments and the stress related to manually paying each month by signing up for automated bill payments. Many vendors offer this service for free or little charge.

- Go Paperless – you’ve put in the time to gather up and organize your information, don’t fuel the complexity fire again by inundating your mailbox with EVERY paper statement. If you need it (tax documents, annual statements, etc.) save a soft copy or simply print it off to file.

- Pay Down Debt – the average American household with any debt carries an average of $135,768. Not only could this handcuff you financially, but it also brings unnecessary complexity to your life. Take the opportunity to come up with a plan to reduce or even eliminate your household debt.

- Set Up Automatic Investments – consider setting up automatic investments from your bank or paycheck to fund accounts like IRA’s, 529 College Savings Plans, etc. Not only does it help you avoid making impulsive or emotional decisions with your money, but also gives you time back to your schedule and more simplicity to your financial picture.

- Be Patient – this is a process and not an overnight fix. It took time to build your web of complexity… and it will take some time to unravel it. Don’t give up!

Share